7 Apr 2008

Is decorative art an investment?

In fact, thanks to the interest in everything related to art, the decorative art industry is growing and thriving. They are quick to produce artworks that have a mass appeal - brightly coloured landscapes, so called abstracts and reproductions of famous paintings form some of the popular choices. Ornate, elaborate and ‘fancy’ frames help in enhancing the visual factor. One has to admit these fit well into the interior décor scheme and add an element of ‘art’ on the walls. Costing anywhere from Rs 5000 to up to even a lakh or more these have become an integral part of home and office décor and no one can deny their ‘trendy’ look.

The biggest advantage with such artwork is that it can be customized specifically to the client’s needs. Furnishings, wall colours, and other accents can be coordinated with the artwork to give a unique feel. The disadvantage, if it can be called that is that these can hardly ever be a financial investment and will therefore lack in resale value. But then as most buyers who opt for such works will be looking at it from a different perspective, it is a win-win situation for all.

(Published in Financial Times)

2 Apr 2008

Ceramic art (Sculptures by G Reghu)

I first came across Reghu’s sculptures about four years ago. Tiny ceramic figures that were based on groupings of men, women and children in animated postures caught my eye. Simple, earthy and quite minimal the figures seemed to be suspended mid-air while depicting various emotions. What stood out the most was their innocent child-like charm. Reghu hasn’t changed much over the years but his sculptures are now larger, they sport a ‘glaze’ finish, and there is a lot more variation in the grouping of figures. The artist comes from a traditional agricultural family, and his sculptures are also inspired by rural lifestyles and traditions. One can even say that his art is an ode to the Indian villager and celebrates their indomitable spirit as they go about their daily existence. Mother and child, or the entire family, cows, and heads of men and women form some of his sculptures. The simplicity and the banality of everyday life that he depicts characterize his figures. At the preview these sculptures were arranged in a garden where they formed a charming set of artworks. In fact, some of these figures reclining on chairs are quite amusing to look at. Devoid of embellishments, the small figures and also the larger sets strike a chord with their rustic appeal.

Reghu’s style of working involves sketching out his sculptures in detail through drawings. He then follows essentially the coil technique to create the figures, which he then fires in a wood kiln, and uses special techniques to obtain a glossy or a glazed look. He incidentally is a graduate in sculpture from the College of Fine Arts, Trivandram and although he began with stone as a medium, he later moved on to working with indigenous materials. He was closely associated with J. Swaminathan at Bharat Bhavan, Bhopal and that has also strongly influenced his works.

His sculptures have no doubt evolved over the years and he has experimented with bronze as well. However, one hopes to see more variation in his choice of theme and the medium in future.

(An exhibition of his sculptures was on till March 26 at Time and Space Art Gallery, Bangalore)

( - Published in Bangalore Mirror)

31 Mar 2008

Indian art market dominates

Incidentally, M F Husain's untitled work went for a hammer price of $409,000, dominating the Sotheby's New York spring sales of Indian art. Prior to that, Saffronart's first contemporary art sale this year closed at a total sale value of over Rs 27 crores (US$ 7.15 million), which was well above its total higher estimate of Rs 19.56 crores (US$ 5.1 million). Emami Chisel Art - a Kolkata based auction house that held a physical-cum-online bidding - brought the hammer down on February 23 and their sales touched a total of Rs 24 crores. Osian’s ‘Indian Modern and Contemporary Art’ auction that was held in New Delhi on March 18 touched a total of Rs 30.28 crore (USD 7.5 million). The highlights of the evening included works by J Swaminathan’s ‘Mountain and Bird Series’ that crossed the Rs 2 crore mark and Tyeb Mehta’s ‘Untitled’ that fetched Rs 1.98 crore. This was Osian’s second auction in the year. While at the earlier Jan 19 auction Osian registered a total sale of Rs 32.18 crore.

If these figures are any indication then it does seem that the Indian art market is poised at a strategic juncture. It is very likely that the renewed confidence in Indian modern and contemporary art will see that the market not only stabilizes but also sees a resurgence of sorts. At the Dubai Art Fair too there has been a lot of interest in the Indian art section, and Jitish Kallat’s works in particular have captured the imagination of many art lovers. Therefore it is not only the modern artists who are seeing a renewed interest in their works but also the contemporary and upcoming artists who are finding many takers.

(Published in Financial Times)

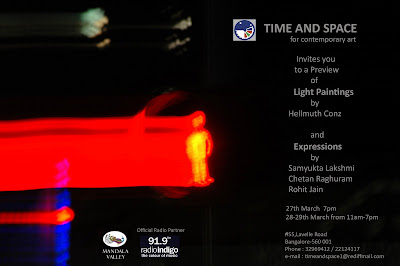

27 Mar 2008

26 Mar 2008

Art market needs more transparency

Now, most art experts feel that the Indian art market is also poised to grow tremendously. Which means the stakes will go even higher. Looking at some of the recent sale figures, M F Husain’s untitled work fetched $409,000, leading the Sotheby’s New York spring sales of Indian art. Prior to that, Saffronart’s first contemporary sale this year closed at a total sale value of over Rs 27 crores (US$ 7.15 million), which was well above its total higher estimate of Rs 19.56 crores (US$ 5.1 million). What is also interesting is that at this sale 25 percent of the bidders were not Indians, according to Saffronart sources.

Controversies have been dogging the Indian art scene as well. A few Indian auction houses have received criticism that ranges from dealing with fake paintings to popular film posters. In fact, all kinds of issues have been raised time and again. Instances of dealers bidding for the works that they themselves have consigned have also been heard.

Market forces that are looking at short-term gains can not only affect their reputation irrevocably but can also impact the entire market scenario. What has emerged in recent times, as we have just seen, is that there is a growing segment of non-Indian buyers who are looking at Indian modern and contemporary art from an investment perspective. I believe that clean and above-board dealings will help strengthen the market, enhance credibility and encourage this buyer base to invest further. Therefore, the point is that the greater the transparency in the market, the better it will be in the long run. And, most importantly it will benefit all.

(Published in Bangalore Mirror)